NV TXR-01.01c 2016-2026 free printable template

Show details

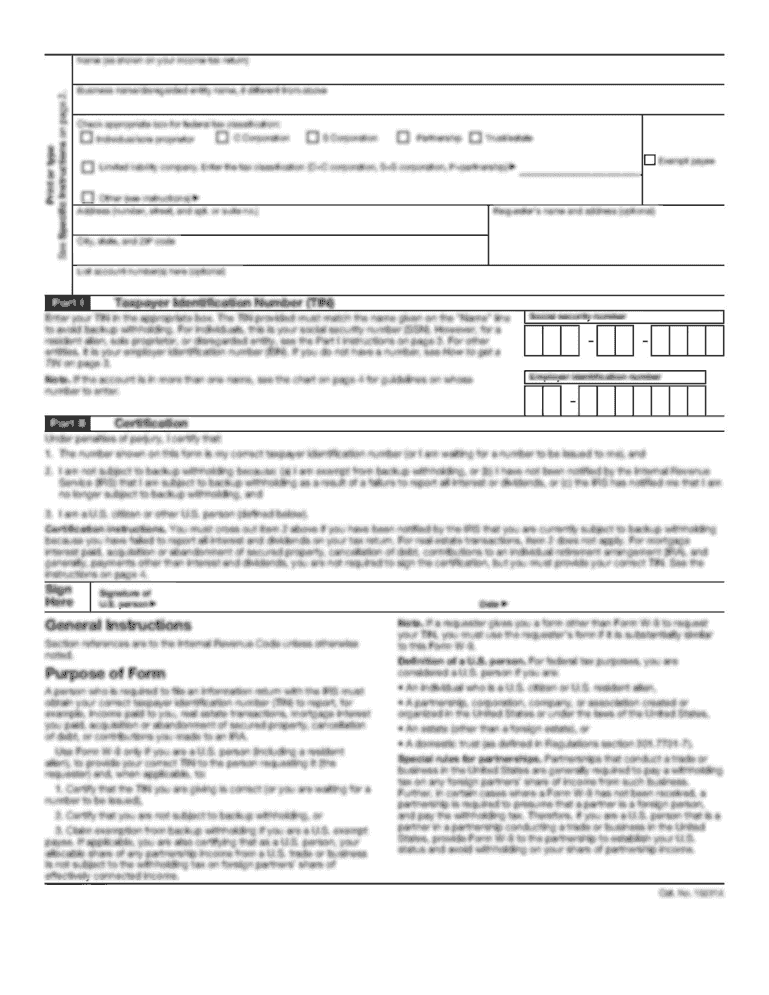

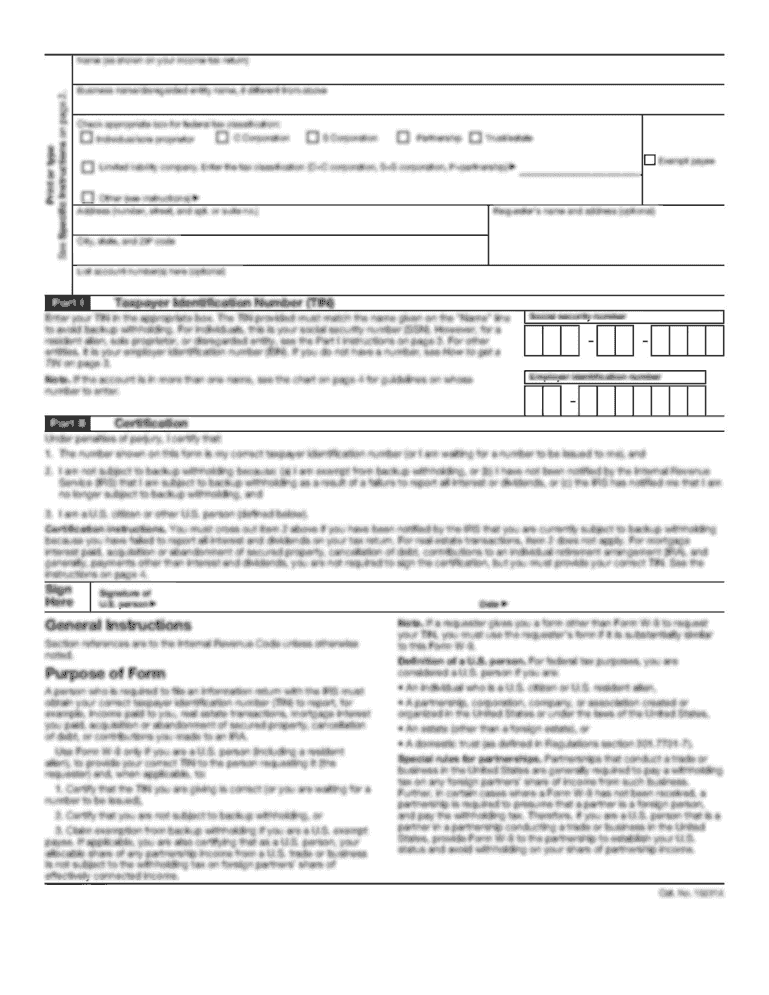

This document serves as a tax return for sellers of tangible personal property in Nevada, detailing required information regarding sales, use tax, and exemptions related to taxation.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign file paper tax return form

Edit your NV TXR-0101c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NV TXR-0101c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NV TXR-0101c online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NV TXR-0101c. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NV TXR-01.01c Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NV TXR-0101c

How to fill out NV TXR-01.01c

01

Gather all necessary personal and business information including your legal name, business structure, and contact information.

02

Ensure you have your previous filing documents available for reference if applicable.

03

Complete the top section of the form with your name, address, and type of entity.

04

Fill in the sections regarding the nature of your business activities accurately.

05

Provide the required financial information as per the guidelines in the form.

06

Review each section of the form for any errors or omissions.

07

Sign and date the form to certify that the information provided is correct.

08

Submit the completed NV TXR-01.01c to the appropriate state office either electronically or via mail.

Who needs NV TXR-01.01c?

01

New businesses registering in Nevada for tax purposes.

02

Existing businesses that need to update their information with the state.

03

Businesses applying for permits or licenses that require state tax registration.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a sales and use tax return in Nevada?

0:39 3:25 File Sales and Use Tax return Online - Nevada Tax - YouTube YouTube Start of suggested clip End of suggested clip Select accounting your reporting in by clicking the radio button left of the county. Name. You willMoreSelect accounting your reporting in by clicking the radio button left of the county. Name. You will now see the window has expanded. And you will enter your sales figures.

Does Nevada have a tax form?

Since Nevada does not collect an income tax on individuals, you are not required to file a NV State Income Tax Return.

Can you fill out tax form with blue pen?

Tax Forms: If you're only signing your tax returns, blue or black ink is fine. On the other hand, if you're filling out tax forms by hand, only black ink can be used so the forms can be easily scanned.

Do you fill out taxes with pen or pencil?

Do you use a pencil or do you make mistakes with pride? Also, definitely use a pen on your taxes.

Can I fill out tax forms in pen?

Although the IRS will usually accept forms filled out in black or blue ink, they prefer that you fill out the form in black ink and sign in blue ink. Red ink is not acceptable for either use.

Are tax forms legal documents?

Income tax forms are the official government documents you're required to fill out when you pay your taxes. Generally, the more complex your finances are the more tax forms you may need to fill out. Each state and city also creates their own tax forms, but oftentimes they are modeled after the federal ones.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NV TXR-0101c online?

Filling out and eSigning NV TXR-0101c is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit NV TXR-0101c in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NV TXR-0101c, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit NV TXR-0101c on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as NV TXR-0101c. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is NV TXR-01.01c?

NV TXR-01.01c is a tax form used for reporting certain tax-related information in Nevada.

Who is required to file NV TXR-01.01c?

Individuals or businesses that meet specific criteria set by the Nevada Department of Taxation are required to file NV TXR-01.01c.

How to fill out NV TXR-01.01c?

To fill out NV TXR-01.01c, follow the instructions provided on the form, ensuring all required information is accurately completed and submitted by the deadline.

What is the purpose of NV TXR-01.01c?

The purpose of NV TXR-01.01c is to collect tax information that aids in the assessment and collection of taxes in Nevada.

What information must be reported on NV TXR-01.01c?

The form must include information such as taxpayer identification, income details, deductions, and other relevant tax data as specified in the form instructions.

Fill out your NV TXR-0101c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NV TXR-0101c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.